With a simple prequalification process plus the guarantee to work with borrowers who may possibly run into trouble during repayment, Joyful Money is really worth a look when you’re batting significant-fascination bank card credit card debt.

Two of the most important necessities for just about any loan are your credit score and also your capability to repay the loan. If your income is all tied up in other expenses or your credit score rating is below 670, it may be hard to qualify.

Bank card loans are thought of revolving credit history. The repayment of credit cards differs from generally structured amortized loans. Whereas the latter demands a established volume being compensated per month, the repayment of revolving credit history is much more adaptable in that the amount may vary, although You will find there's bare minimum payment because of on Every single charge card monthly that should be met to avoid penalty. For more information, use the Credit Card Calculator.

Amongst the benefits of taking out an American Categorical private loan certainly are a rock-base APR for applicants with the most effective credit history, a higher client fulfillment score, and an absence of origination and prepayment service fees.

Condominiums, townhomes, and several one-spouse and children properties generally involve the payment of HOA fees. Annual HOA fees ordinarily sum to fewer than a person p.c in the home worth.

Be aware: Not each and every lender features prequalification and requires a tough credit rating pull to ascertain your loan eligibility. When assessing lenders, you could possibly contemplate on the lookout for lenders that make it possible for prequalification.

Evaluating lenders’ interest fees, costs, terms and loan quantities can save you income In the end.

Scholar loans guideFAFSA and federal college student aidPaying for career trainingPaying for collegePaying for graduate schoolRepaying pupil debtRefinancing student debtBest non-public college student loans

Consider a personal line of credit score: Even though a personal loan provides a a single-time lump sum of money, a private credit history line offers you entry to revenue in excess of a length of time. A personal line of credit may well cost an increased APR than the usual charge card or individual loan.

You will find lenders that demand banking account details as financial institution statements can confirm your economic circumstance.

When you qualify, a private loan can have aggressive curiosity premiums and small or no service fees. But discovering the best healthy relies on quite a few elements, which includes your credit score profile.

Enter your curiosity fee. Your personal loan curiosity price is based totally on your credit history profile and fiscal facts. Fantastic-credit borrowers with very low credit card debt-to-profits ratios frequently get the lowest prices.

Except for its credit history rating prerequisites, Avant also demands that applicants give latest bank statements and spend stubs.

Every month house loan payments usually comprise the majority from the financial prices linked to proudly get more info owning a dwelling, but there are other sizeable fees to remember. These costs are separated into two categories, recurring and non-recurring.

Tia Carrere Then & Now!

Tia Carrere Then & Now! Andrew Keegan Then & Now!

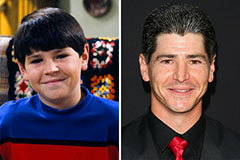

Andrew Keegan Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!